The Yono app was launched by SBI in India around three years ago, since then, the app has been changed a lot, and some great features have also been added to it. Some features have been changed or added with updates. So, if you are an existing State Bank customer or not, check here how to use Yono SBI.

In this article, we will cover all about Yono SBI App, whether you are a customer of this bank or not. If you are using Yono SBI for the first time, you should know about some features of the yono app.

First of all, download the Yono app from the Play Store. Now, open and you will get three options, the first option is ‘New to SBI,’ the Second is ‘Existing Customer,’ and the third one is ‘I have Activation Code.’

How to use Yono SBI? (non-customer)

If you are not a state bank customer, you can still use the YONO app by opening a paperless basic savings account. It is straightforward, and all you need is Aadhar and PAN card.

If you are new to SBI (for non-customers), you need to tap on ‘New to SBI‘. Then, on the next screen, select “Apply Now” to open a savings account and tap on ‘Next’ to continue. Here, you can open an SBI paperless savings account by using your PAN and Aadhaar card.

There are two types of savings accounts, Insta Savings Accounts and Digital Savings Accounts. The ‘Insta savings account‘ is an entirely paperless basic savings account and doesn’t need to visit the branch.

Paperless Savings account features:

The complete details of the paperless savings account in SBI are as follows.

- A branch visit is required within a year for full KYC

- Change zero balance to salary account

- PAN is mandatory

- Details are emailed only monthly

- Paperless account

- Personal debit card

- Single operating account

- The chequebook is available on request

Steps to open savings account in SBI through Yono app

Step 1: Tap on the next option, and the next screen will appear. Enter your details here. A mobile number is mandatory, but your email and referral code is optional. Tap on Next.

Step 2: If the mobile number is registered with PAN, you will get an OTP on your registered mobile number, enter the OTP, and tap on Next.

Step 3: Tick the checkbox (FATCA / CRS announcement), enter your PAN number, select the box, and tap on Next.

Step 4: A list of announcements will appear here; tap on Next. Select any document here for identity proof, such as Voter Card, Aadhaar Card, Passport, etc.

Step 5: Tap to Next, and there are a few more steps to be taken for a paperless savings account.

Being an SBI customer how to use Yono SBI?

Tap on the Existing Customer, here you will get three options, the first is ‘Login Internet Banking ID, ‘the second is “Register with my ATM Card and the third is” Register with Account Details. “

Select the first option, and tap ‘Yes.’ On the next page, enter your user ID and password, and tap on submit.

Check the box (Terms and Conditions) and tap Next.

You will get an ‘OTP ‘on your registered mobile number; enter your OTP.

Tap on Next, and here you have set Six Digit MPIN for secure login. In this way, you can use ‘SBI Yono‘ for fund transfers, Mobile recharge, bill payments, paying credit card bills, Cardless cash withdrawals, etc.

1: If you register with an ATM card:

If you choose the ‘Register with ATM card’ option, enter your Account and CIF Number, and tap on Submit. Next, you have to create a username and password to activate internet banking.

2: If you select the third option, ‘Registration with Account Details,’ you will have to complete three steps to register on SBI Yono on the next page.

You will get a reference number for your user ID and password; go to the branch and activate your user ID and password.

Tap on the Continue option, and enter the account number and date of birth on the next page. Finally, tap on ‘Next‘.

There are some more steps to be taken to complete your registration with the bank account.

Yono fund transfer

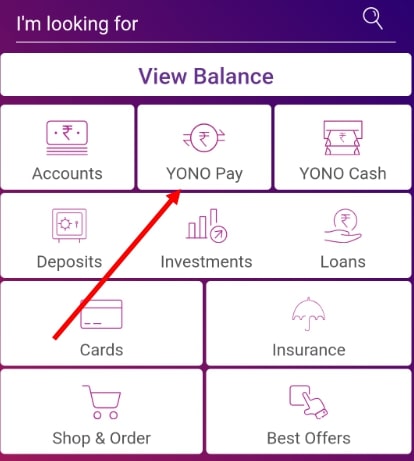

For fund transfer, first, you have to log in; you will have the option of ‘YONO Pay’. Select YONO Pay; you will get the main five options for fund transfer on the next screen.

For example, ‘quick money transfer, through a bank account, through Bhim UPI, through contacts and QR scan’.

YONO Quick Transfer

When transferring funds, you need a Profile Password, therefore, to create a profile password. First, go to Settings, where you can set/reset your Profile password, Internet Banking ID/ Password, and MMID.

Open the YONO app, tap on YONO Pay and enter your profile password. Two options will appear; If you select the account, you will get two options, ‘SBI Account‘ and ‘Other Bank Accounts.

For an SBI account, enter the payee name, account number, and the maximum amount of money transfer, and provide a nickname.

Tap on the ‘Next‘ option, and on the next screen, enter the amount to send and tap on the ‘continue’. Here, enter your PIN and confirm. Funds will be transferred in this way, but it is a long process.

If you select the Phone number, you must enter the MMID. Other options are the same. For example, if you choose another bank account, you will need to enter the IFSC CODE.

Transfer through BHIM UPI

If you select BHIM UPI for fund transfer, first of all, you have to Create/Retrieve your UPI PROFILE. Tap on BHIM UPI. On the next page, choose the Create / Retrieve UPI profile.

Here, if you have two SIM cards on your mobile, choose the SIM card, which is registered with your bank account, then select the account number and tap on the ‘Next’ option. On the next screen, enter your UPI PIN or reset your UPI PIN.

There are many options available for fund transfer, such as UPI ID, Contact, Bank account, QR scan, etc. But, BHIM UPI is the best option for instant money transfers.

Conclusion:

The SBI YONO app is handy if one has an account with SBI. Through this app, Non-SBI customers can also easily open a paperless savings bank account. SBI customers can also create an Internet banking user ID and password through the YONO app with the SBI ATM card. Users are not required to visit the branch for bill payments, or cash withdrawals. Instead, users can do all the work related to the bank through this Yono app.

There is no need for users to keep any debit card in their wallets. A ‘YONO Cash’ option allows customers to withdraw cardless cash from the SBI ATM through the YONO SBI. This app allows users to reset their Bhim UPI PIN, Internet Banking ID, Password, Profile Password, MMID, etc.