Union Bank of India is a national bank that provides various banking services. To avail of digital banking facilities, the customer needs to register for Internet Banking, UPI or Mobile Banking. You do not need to visit any Union Bank, you can do so through online and mobile banking.

Now UPI is the most used platform for online transactions, it is simple and so easy for users. Union Bank also provides UPI facilities, so, download the Union Bank mobile application for further process.

You have to register for mobile banking and BHIM UPI ID. then activate your UPI ID, set your UPI Pin and also set the UPI transaction limit. Download the “nxt” mobile app and complete the registration process for Mobile Banking and BHIM UPI ID.

Mobile banking lets you create all the essential services in your existing bank account in a few minutes. In this tutorial, we will cover all the UPI functions in your Union Bank account.

How to Register for UPI in Union Bank of India?

These are a few steps required to register for UPI functions in the Union Bank of India. Go to the Play Store and download the latest “nxt” app on your mobile. You need to activate your mobile banking and BHIM UPI ID so check the steps given below.

Step 1: Open your “nxt” (U-Mobile) application, click on allow and Activate.

Step 2: On the next screen, select the registered sim linked to a bank account if you have two sim cards.

Step 3: Here, you will get two options, ‘Mobile Banking and BHIM UPI’. If you want to enable both, click ‘Proceed’.

Check also-SBI UPI Transaction Limit Set

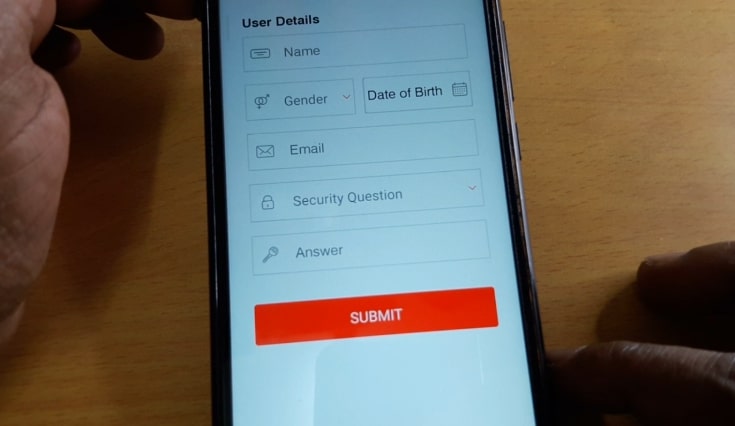

Step 4: Enter your name, gender, date of birth, and email id, and answer the security question. Click on ‘Submit’. Create a Login PIN and confirm it and submit.

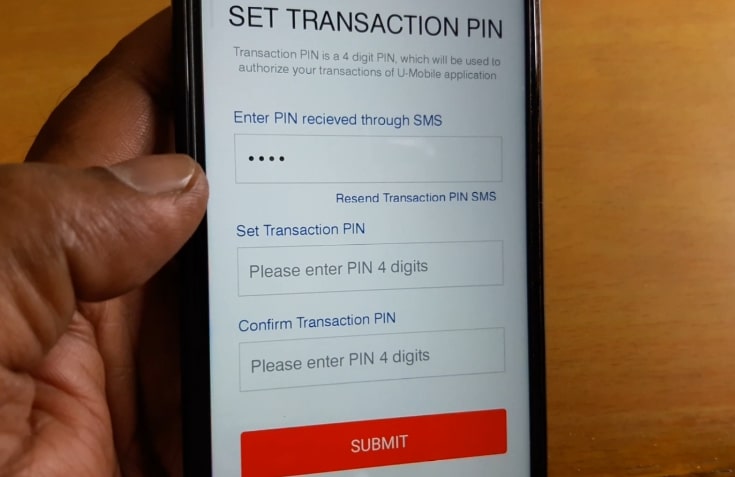

UPI Pin:

The transaction pin is the UPI Pin in your Union Bank account. You need to enter this 4-digit transaction PIN to send money to anyone. But, upon receiving the money, you are not required to enter your transaction PIN.

Step 5: You will receive a four-digit PIN via SMS; enter it. Enter the transaction Pin and confirm it. Click on Submit.

This way, the transaction PIN will be set in your Union Bank account for UPI transactions.

See also- Reset SBI Profile Password

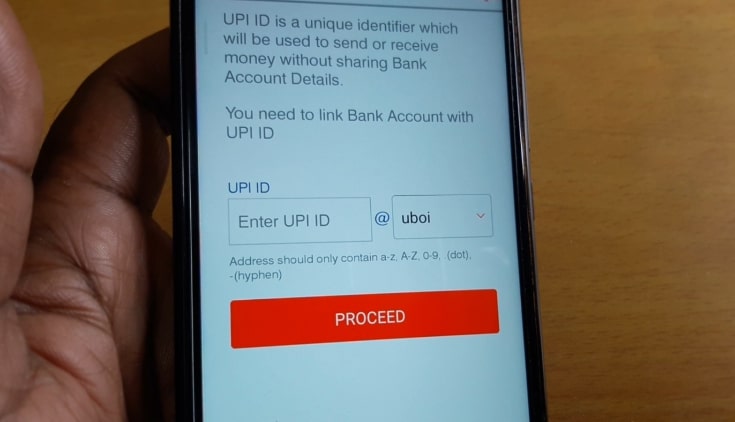

UPI ID:

Step 8: Click on the Manage Option; On the next screen, you will get the option of Create UPI ID.

Step 6: You must log in and find a list of UPI IDs. Select anyone from the UPI ID list and confirm.

So this way, you will be able to create a UPI ID in your Union Bank account.

Learn more- 5 UPI Safety Tips

Union Bank UPI Transaction Limit Set

It is very easy to set a UPI transaction limit in any bank account, you can do it in a few steps, in Union Bank as follows: Check here for more details.

1: On the home screen of the “nxt” (U-Mobile) app, click on the top left of the menu bar.

2: Click on ‘Manage UPI ID.’

3: You will get an edit option on the current transaction limit section.

4: Select the Edit icon; On the next screen, enter your desired amount to set the current limit for UPI transactions.

5: Click on ‘Update‘. This way, you can set the UPI current transaction limit in the Union Bank of India.

FAQs:

The daily transaction limit through UPI is Rs.100000/- per day. But, it will be defined by each bank and can be changed.

The limit of a single transaction in UPI is also Rs.100000/-.

UPI PIN is a four or 6-digit number that must be entered while sending funds to other accounts.