In mid-2016, the Unified Payment Interface (UPI) was launched by NPCI. The unified Payment Interface allows users to send money to bank accounts in real time. Furthermore, it can complete transactions in fewer steps than other typical payment methods.

It allows users to transfer money from one bank account to another bank account instantly through a mobile phone. The UPI payment methods work on a 24×7 basis through the UPI app on mobile devices.

But, this will be possible through UPI apps only if you have a unique UPI ID. So, the UPI is a virtual address of your bank account that will be linked with your registered mobile number.

You need to know your UPI ID as it is required for online transactions sometimes. Also, you can share your UPI ID to receive funds from any users. So, you need to know what is your UPI ID, in this tutorial, we will cover how you can find your UPI ID in several mobile applications.

What is UPI ID?

UPI ID is a payment address linked to your bank accounts and is required for online transactions. By default, it looks like a phone number (98xxxx210@abc) or an email ID (demoabac4@abc), but you can edit it anytime you wish.

Each bank account has a unique UPI ID and allows linking multiple bank accounts in a single mobile app. UPI is the most secure and trusted payment system in India. So, the UPI ID is a virtual payment address where you can transfer funds to the bank account without knowing bank account details.

How does UPI ID works?

UPI ID is a virtual payment address where you can send and receive money directly to the bank account through UPI ID. You must register your phone number with your bank account for verification purposes.

Install the UPI app on your mobile, and select your bank from the list of bank options. It will verify by sending OTP to your registered mobile number. You will find your UPI ID in the profile section; you can change it anytime.

See also: 5 UPI Safety Tips

How to Know UPI ID in different UPI apps?

Nowadays, most Indian banks support UPI, and all you need to do is check once and download the UPI app on your smartphone. The most used apps for payment through the UPI method are BHIM, developed by NPCI. The most popular Third-party UPI Supported Apps and mobile banking apps are given below, in which you will get the UPI ID in just a few steps.

- Phonepe

- Paytm

- Google Pay

- Freecharge

- Mobikwik

1. Phonepe UPI ID

PhonePe is one of the most popular third-party mobile payment applications in India, where you can check the UPI ID in a few steps.

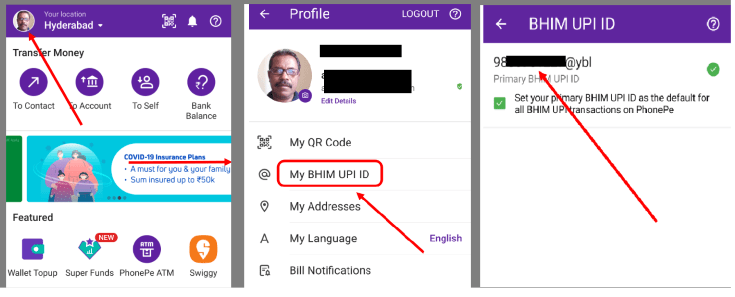

- Open PhonePe app

- Tap on the ‘Profile‘ icon on the top left

- Select the ‘My BHIM UPI ID‘ option

- The BHIM UPI ID will appear on the next screen

We have shared the below image and the text option to view UPI ID in PhonePe.

Check also: How to set UPI transaction limit in SBI

2. Paytm UPI ID

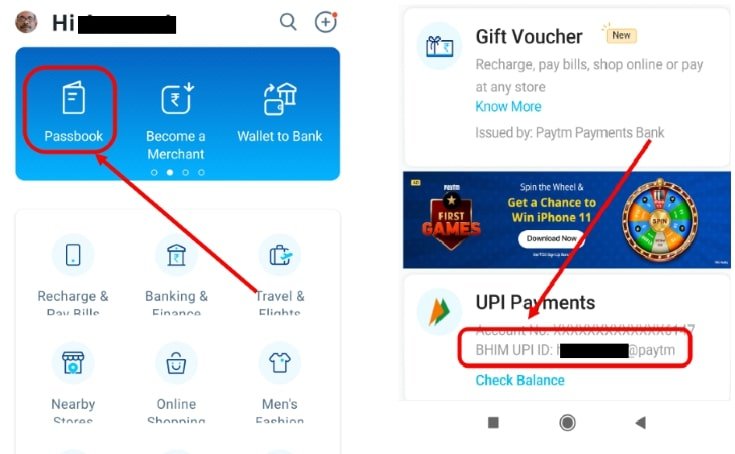

Paytm is another great mobile app where you can get multi-function features. To check the UPI ID in Paytm, select the ‘Passbook‘ option on the home screen. On the next screen, you will find the UPI ID at the bottom.

It is clearly shown in the image below to make it easy for you to find out.

3. Google Pay UPI ID

Google Pay is one of India’s most secure and trusty mobile payment apps where you can send and receive money instantly. So, to check the UPI ID, open the G Pay (Formerly Tez) app and select the profile image at the top right. The UPI ID will appear on the next screen on the top left.

It is clearly shown in the image below:

4. Freecharge UPI ID

Nowadays, the usage of the Freecharge mobile app is very less. Still, many users use it. On the home screen, the UPI ID will be included. There is no need to go to the next screen.

Learn more- Reset SBI Profile Password

5. Mobikwik UPI ID

- Open the Mobikwik app

- Tap the profile icon for the UPI ID you want to view at the top right corner.

- UPI ID will appear on the next screen, as shown in the image below (mobilenumber@ikwik).

FAQs

A: You can change your UPI ID by selecting the edit option.

A: You must register your mobile number with your bank account for UPI ID.

A: UPI transaction limit is Rs 100000/- per day. But it may differ from bank to bank.

Conclusion:

UPI ID will be available only after linking the bank account, and the UPI ID of each bank will be different. UPI transactions are the most accessible and secure payment systems in India. You can transfer money to another bank account through UPI ID in fewer steps without any kind of fraud.