UPI ID is required for SBI customers if they use Unified Payments Interface (UPI) to receive and send money. A UPI ID is a virtual payment address for the Unified Payments Interface that links directly to your bank accounts. So, if you have an account with SBI, you can create your UPI ID through the YONO SBI app.

YONO SBI is an all-in-one app that provides all banking facilities along with UPI. Here, offers various banking services along with bill payments, recharges, and cardless cash withdrawals.

So, if you want to know how to create a UPI ID in SBI through YONO App, then this article will help you. Check here if you want to learn more about UPI IDs, like Amazon UPI ID.

How to Create SBI UPI ID Through YONO?

These are the important steps that need to be followed to create a UPI ID in SBI.

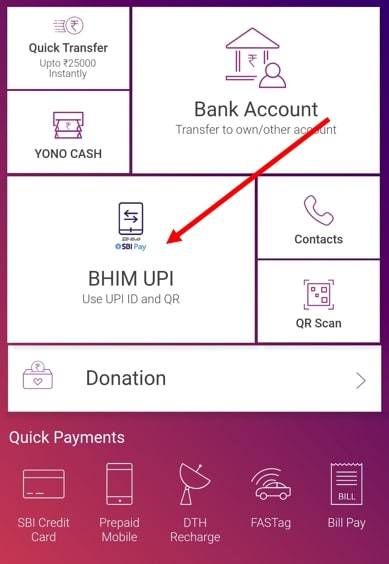

Step 1: So, open the YONO app and tap on the ‘YONO PAY‘ option. You will get the option of ‘BHIM UPI‘.

Step 2: Tap on BHIM UPI. On selecting the BHIM UPI option you will get the option of ‘Create /Retrieve UPI Profile.

Step 3: Tap on Create/Retrieve UPI Profile option. UPI ID can be like your email ID, phone number, etc. It will be linked to your bank account and mobile number.

Check here- QR Cash withdrawal in SBI

Step 4: If you have two mobile numbers on the next screen, you have to select the registered mobile number linked to your bank account.

Step 5: On selecting the phone number, an SMS will be sent to your registered mobile number to verify the bank details. It will be verified automatically, and the complete list of banks will appear. Select your bank from the list in which you have an account.

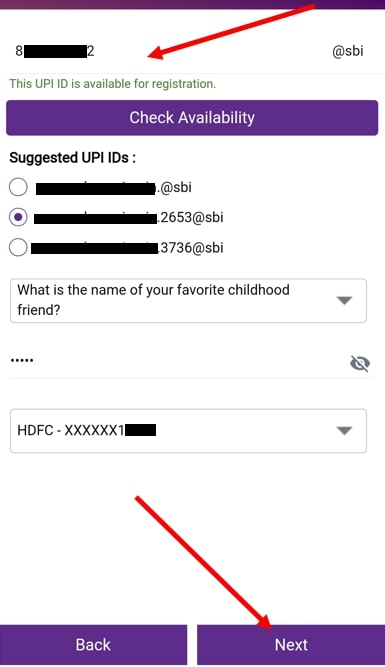

Step 6: Here, you will find three suggested UPI IDs options, choose one of them and select the secret question and its answer. Tap on Next. Otherwise, you can create the UPI ID here, which appears at the top.

Step 7: Enter your preferred UPI ID and tap on the Check Availability option. If the UPI ID is available for registration, then tap on Next.

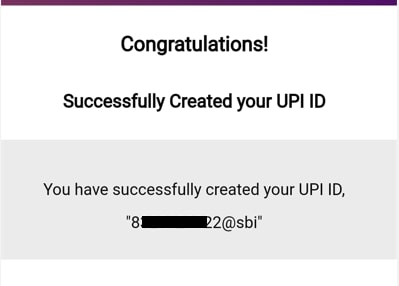

You will get a message of congratulations on the next screen and successfully create your YONO UPI ID. If you think this guide might be of help to someone, do share it with your groups. If you have any suggestions please comment.

YONO SBI Top Features:

These are the top features of YONO SBI that you will get after registration.

- SBI YONO Pay

- Manage Banking Services

- YONO Safety Features

- Bill Payments

YONO PAY: Here, you can transfer money through the ‘SBI Yono Pay option in many ways, such as QR Code, ‘Quick Transfer‘, ‘Bank Account‘, ‘BHIM UPI ID, Phone Number, etc.

Manage Banking services:

It helps manage various banking services like changing debit card pin, debit card closure, ordering a new debit card, changing phone number, login password, SMS alerts, continuing or closing chequebook, etc.

YONO Safety features:

You can change or remove your m-PIN, reset your Internet Banking password, change your profile password, set your daily UPI transaction limit, etc. There is no need to go to the bank; you can manage everything in your account.

YONO Bill Payments:

Apart from this, you will get many online facilities like bill payment, ticket booking, loans, credit card payment, etc. Moreover, you do not need a debit card to withdraw cash from SBI ATMs in the YONO Cash option.

FAQs

A: You can find your UPI ID through the YONO app. You have to select the YONO PAY option, then tap on BHIM UPI, on the next screen you will get your UPI ID.

A; Yes, you can link other bank accounts in YONO SBI for UPI ID. Here, I have linked my HDFC Bank account.

A: Yes, you can change your UPI ID in SBI anytime through YONO App.

A: UPI ID is a Virtual Payment Address that links to the bank account. Here, you need to register your mobile number with your bank account.