The use of UPI for fund transfers has increased significantly as the user does not require a username and password. It is easy to transact, and most fraudsters try to cheat UPI users somehow. Therefore, you can fix your minimum transaction limit per day to avoid losing a hefty amount from such fraudulent incidents.

All banks have different per-day limits, State Bank allows Rs 1,00,000 per day. Similarly, ICICI Bank allows Rs 10,000 to Rs 25,000. So, you can set it up to a specified limit or less. But, if you want to increase your daily transaction limit, you can do so as well.

You cannot set transaction limits through PhonePe, Google Pay, or any third-party payment app. Hence, you will need mobile or internet banking of the linked bank account to set the limit. Once the limit is fixed, you can transact up to the specified limit through any third-party payment app.

So, if you have linked your State bank account, you need the YONO app or internet banking to fix your daily limit. Similarly, for Union bank of India, you will need a U-Mobile app. But, in this tutorial, we have shared the State Bank UPI transaction limit, that is, how you can fix the UPI transaction limit.

How to Fix the UPI Transaction Limit in SBI?

It is straightforward to set your daily transaction limit, Install Yono Lite, and log in with your Internet Banking credential for the first time. Later you can set the M-pin to login.

Step 1: After login, you will get the option of UPI Transfer at the top of the home page.

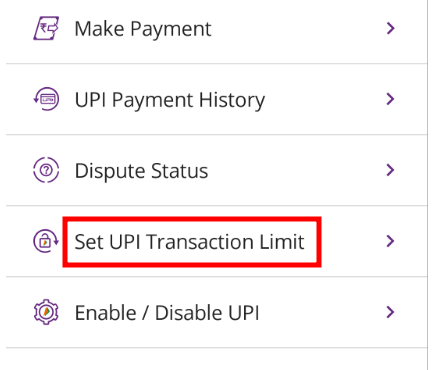

Step 2: Tap on UPI Transfer. On the next screen, you will get the option of a Set UPI Transaction Limit.

Step 3: Tap on ‘Set UPI Transaction Limit‘. On the next screen, enter your Profile Password and tap on Submit. Check here for more details about SBI Profile Password.

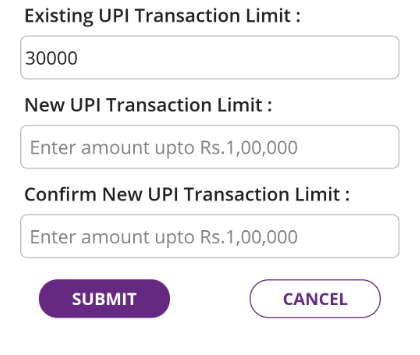

Step 4: Now, you have to set a new UPI transaction limit here, enter the amount you like and re-enter the same amount, and click on Submit.

Step 5: On the next screen, select Confirm. You will get OTP on your registered phone number. Enter OTP and tap on submit.

Step 6: You will get a message; ‘Your UPI transaction limit request has been successfully set’.

That’s all; you don’t need to do anything. Now, you can add your State Bank account to any UPI payment app. But if you want to know how to do it through SBI Internet banking, follow the steps below.

See also– SBI Debit Card Pin by SMS

How to Increase UPI Transaction Limit per day?

UPI-supported apps allow you to add multiple bank accounts in a single app. If you have the YONO SBI app, you can add one more bank account to increase the daily transaction limit. Similarly, in any third-party payment app, you can increase your daily limit by adding multiple bank accounts.

But, if you are looking for a video format, below, we have shared a Youtube video of our channel.

Watch This Video:

How to Set Transaction Limit through Net Banking?

Visit the official website of SBI Online and log in with your username and password.

1: Click on the “My Accounts & Profile” tab.

2: On the next page, select the “Profile” tab.

3: Click on the “Define Limit” option; next, enter your profile password, and click on “Submit“.

Learn more- SBI CIF Number Without Passbook

4: Now, click on the link for general categories.

5: Select a limit to set up, enter the amount you want to set, and click on “Submit“.

6: You will receive an OTP, enter the OTP and click on “Confirm“.

Finally, your transaction limit will be reset successfully in SBI.

But, if you want to disable UPI services in SBI, not the transaction limit, you can do it through a mobile app and net banking.

Disable UPI Service in State Bank

To disable the UPI services in State bank via mobile app, you must install the “Bhim SBI Pay“.

But, when you want to enable it, you can do it anytime and anywhere. For this, the link is given here.

Check also – Union Bank UPI Transaction Limit Set

UPI Transaction Supported Channels

The unified Payment Interface supports various payment methods, such as QR codes, Mobile numbers, UPI IDs, Bank accounts, etc. Install the payment app once on your mobile, and complete the registration method. Now you are ready to use it.

You can set your transaction limits through the Yono Lite app for your State bank accounts. The limit of UPI transactions will depend on how many transactions you perform daily through the Unified Payment Interface. So, set your limit and add to any UPI app.

FAQs:

A: The maximum transaction limit for UPI is Rs 100000, and the transaction limit can be set up to or less than the maximum UPI transaction limit (Rs 100000) in SBI. So here, you can set a limit of less than or equal to Rs 100000.

A: You can easily set the UPI transaction limit in SBI through the YONO Lite app. You will get the option to ‘Set UPI Transaction Limit’. Tap on the next screen, enter the preferred amount and submit. You will get a ‘One-time password’ (OTP) on your mobile, enter OTP and confirm.

A: You can add multiple bank accounts to increase your UPI transaction limit in any payment app.

A: The per-day limit for UPI transactions in SBI is 1 lakh, and the per-transaction limit is Rs 25000.

A: You can not transfer money abroad using UPI in SBI.

Conclusion

A unified Payments Interface (UPI) is one of the most used platforms for fund transfer and it does not require a user ID and password. In recent years the use of UPI has increased as it is easy to transact. You need to enter your UPI Pin for fund transfers so, most fraudsters try to cheat UPI users somehow. So, set a minimum transaction limit that will help you save a huge amount from any kind of online fraud.